Get Making Tax Digital for Income Tax Sorted Today

If you're looking for accounting software to comply with Making Tax Digital (MTD) for Income Tax then this isn't the place for you. But if you want a simple bridging solution that lets you submit your figures with little to no change to your workflow, then you've found your home.

!Easy MTD is HMRC-recognised software that allows taxpayers and agents to comply with MTD for Income Tax - hassle free and with minimal cost. It replaces HMRC's Self Assessment service, and provides tools for dealing with everything that MTD for Income Tax throws at you.

With !Easy MTD you can keep using spreadsheets or incompatible software, meaning no steep learning curve and more time running core activities.

Sign Up DownloadHMRC are still applying the finishing touches to MTD for Income Tax. Therefore, Income Tax functionality is not yet available in !Easy MTD. It will be implemented prior to the 6 April 2026 deadline.

What is Making Tax Digital for Income Tax?

Making Tax Digital (MTD) for Income Tax is HMRC’s new way of reporting income. Instead of filing one annual tax return, taxpayers use MTD-compatible software to submit quarterly updates and other figures digitally to HMRC, prior to making a final declaration - keeping tax information accurate and up to date throughout the year and minimising the pre-deadline panic.

If you’re a sole trader, landlord, or construction worker, or if you’ve previously filed a Self Assessment tax return, you’ll need to start using MTD for Income Tax once your qualifying income passes one of HMRC’s thresholds. When that time comes, HMRC will contact you and you’ll no longer be able to use the online Self Assessment service. Instead, you’ll need software like !Easy MTD, which makes the entire MTD for Income Tax process quick, simple, and compliant.

When Does It Start?

If you have qualifying income of £50,000 or more you need to start using MTD for Income Tax from 6 April 2026. Taxpayers with a lower qualifying income start in subsequent years. Read more...

How Do I Comply?

You must use MTD for Income Tax compliant software such as !Easy MTD to submit your Income Tax figures to HMRC, making sure to digitally record and link certain ones. Read more...

What Figures Do I Digitally Record and Link?

Only business and property income and expenses need to be recorded digitally and digitally linked to !Easy MTD. Everything else can be digitally linked, typed and copy-and-pasted into !Easy MTD. Read more...

How Do I Get Going?

Start or continue recording your business and/or property income and expenses in a spreadsheet, then download, install and configure !Easy MTD. You can then submit your first quarterly update. Read more...

Need a Spreadsheet?

Grab yourself an Excel spreadsheet for your business or property income and expenses. You can use it to complete your quarterly updates alongside !Easy MTD.

Download*Only quarterly update income and expenses figures need to be recorded digitally and digitally linked under MTD rules. Everything else can be digitally linked, typed and copy-and-pasted into !Easy MTD.

Who Can Use !Easy MTD

!Easy MTD can be used by anyone that needs to file income under Making Tax Digital for Income Tax.

Self-Employed

Whether you're a hairdresser, driving instructor, photographer or anyone else that freelances or operates a self-employed business, you can use !Easy MTD to comply with MTD for Income Tax.

Landlords

If you're a landlord for UK and/or foreign property, you can use !Easy MTD to submit quarterly updates for each income source, and your personal income, reliefs and deductions digitally to HMRC.

Construction Workers

If laying bricks, fiddling with cables, or running pipes is your thing, !Easy MTD is perfect for reviewing and submitting your CIS deductions and all other applicable tax information.

Agents

Whether you submit for one or one hundred clients, !Easy MTD can be used for taxpayers that record their Income Tax figures in a spreadsheet or non-MTD compliant accounting software.

Why Choose !Easy MTD

Just some of the reasons why you should choose !Easy MTD as your Making Tax Digital for Income Tax solution.

HMRC-Recognised

!Easy MTD is 100% compliant with MTD for Income Tax, and is listed on HMRC's "Find Software" web page.

Tailored Tax

Select only the !Easy MTD components you need for your individual tax purposes - keeping the interface clutter-free and you on top of progress.

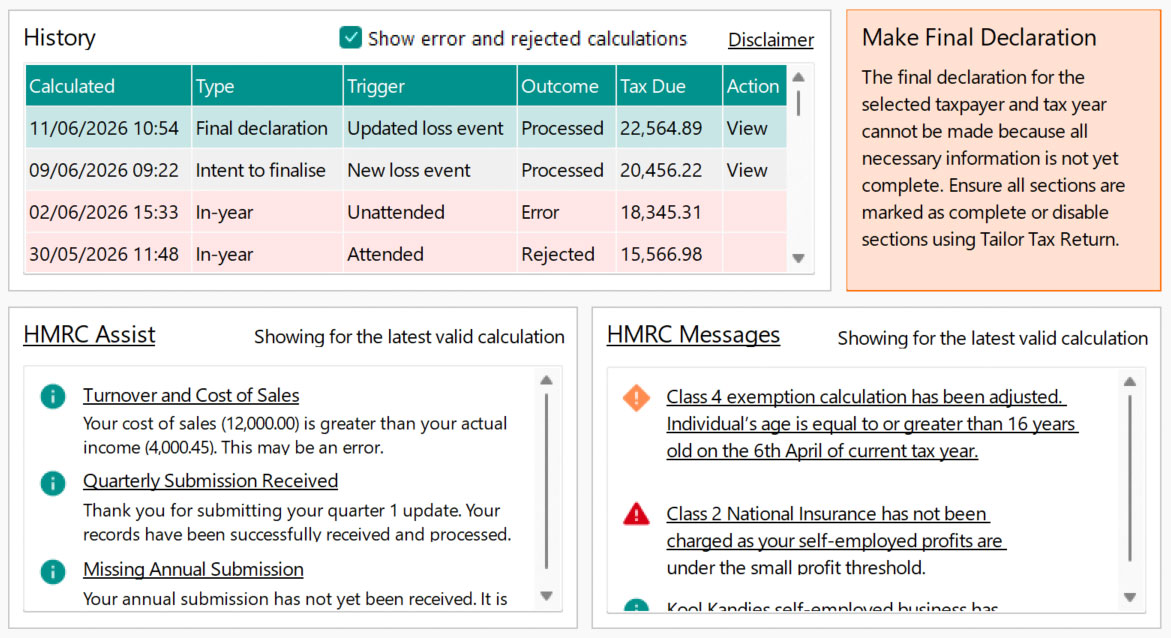

HMRC Alerts

Get prompts from HMRC within !Easy MTD about what you need to do next during your MTD for Income Tax journey. HMRC assistance has never been so accessible!

Installed Software

Relive the good old days and keep financial figures secure by installing !Easy MTD on your computer or laptop - not a Cloud in sight.

No Change

Use your existing spreadsheets or software that isn't MTD compatible - no need for expensive or complicated accounting software.

Everything Income Tax

From submitting quarterly updates and personal income, reliefs and deductions, to making a final declaration, !Easy MTD does it all - end-to-end compliance the easy way.

Unrivalled Support

We understand that MTD for Income Tax may seem daunting which is why we offer a wealth of support resources, a friendly AI helper and access to a UK-based support team.

Suitable for Everyone

Whether you’re filing for yourself or on behalf of one or hundreds of clients, !Easy MTD gets the job done quickly, securely and with minimal cost.

Try For Free

Sign up for an !Easy MTD account and you'll receive a complimentary token that will allow you to submit your first quarterly update for free*

Sign Up*Only available for new sign-ups, and only one free token per taxpayer or agent. Fly Software reserve the right to remove free tokens from ineligible accounts.

All You Need to Get Making Tax Digital Sorted

!Easy MTD provides all the tools you need to comply with Making Tax Digital for Income Tax

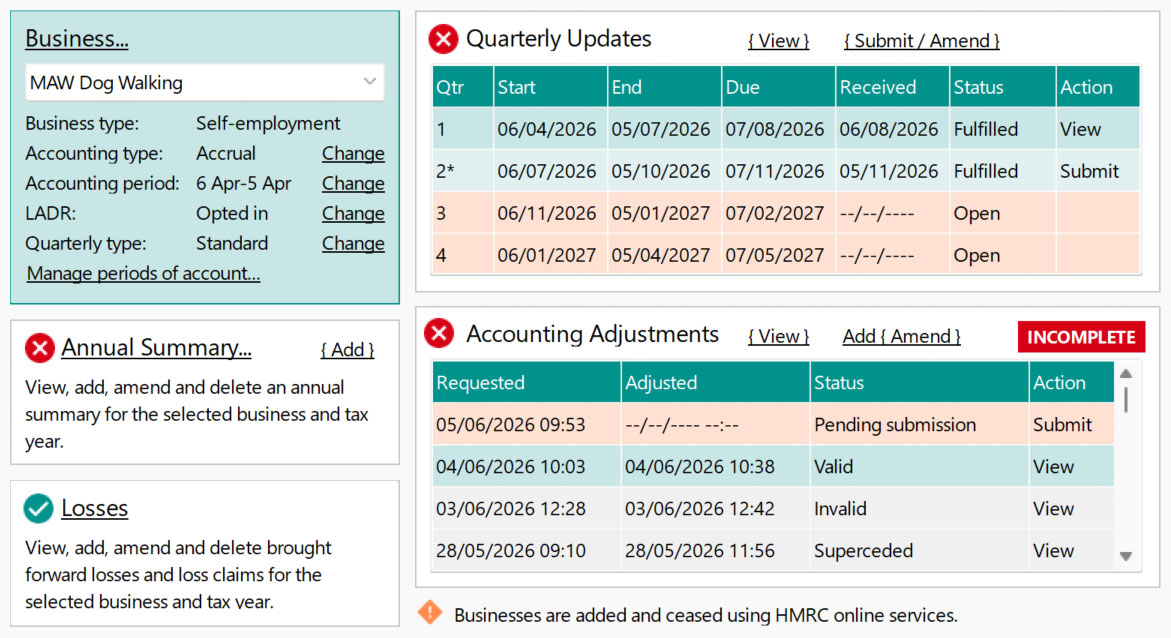

Business Figures

Submit quarterly updates, annual summaries, accounting adjustments and brought forward losses for all your business and/or property incomes.

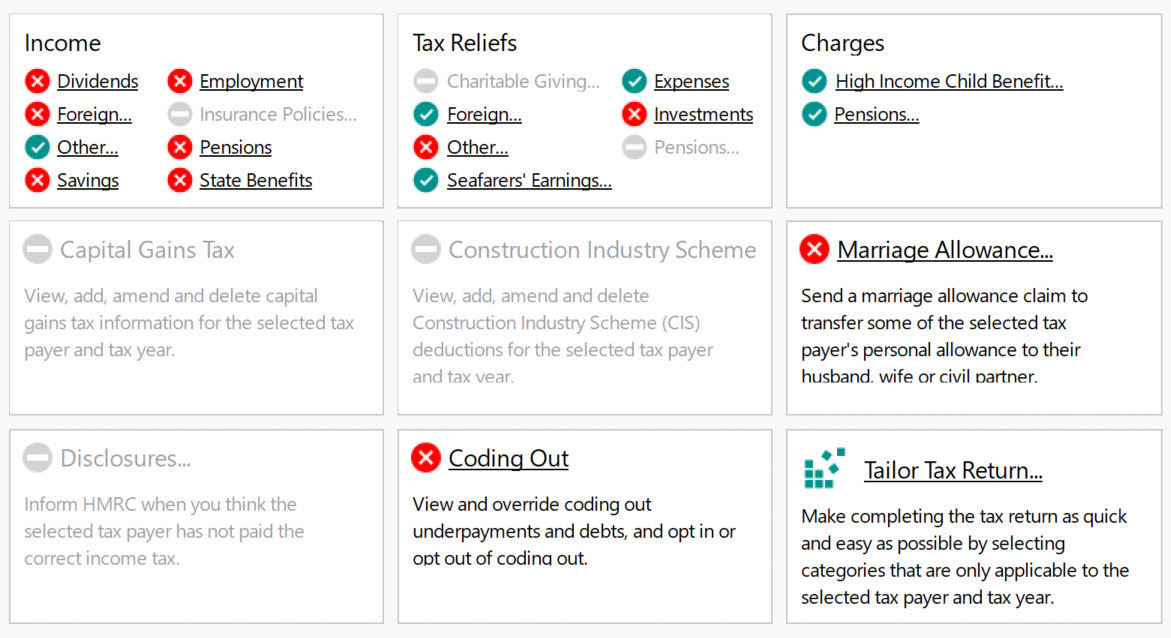

Individual Figures

Report your personal income, tax reliefs, deductions, marriage allowance, CIS deductions, and anything else previously specified in a Self Assessment tax return.

Tax Calculation

Review the tax calculation produced by HMRC at any time and when you're finished submitting and happy with the results, submit a final declaration.

How !Easy MTD Works

Download, Install and Configure

Download the !Easy MTD setup file, install it, add a taxpayer then connect to HMRC. You can now select the obligation for the tax year you need to file.

Submit Business Figures

For each self-employment and/or property income, submit quarterly updates throughout the year and annual submissions and accounting adjustments at year end.

Submit Individual Figures

Review individual income, tax reliefs and deductions at any time, and, if necessary, submit applicable figures before the 31 January deadline.

Make Final Declaration

Review the latest tax calculation produced by HMRC that is based on figures previously submitted and already held. When satisfied, make the final declaration.

Next Steps

If you're wondering what to do next with Making Tax Digital for Income Tax, take a look at the following to kick start your journey:

Sign Up

You'll need an !Easy MTD account before you can submit quarterly updates and make final declarations. Sign up here today and we'll gift you a token.

Download

!Easy MTD isn't Cloud software, so you'll need to download then install it. It works with Windows 10 and 11 (and 7 and 8) so if you're using one of these you're good to go.

Buy Tokens

You'll need a token to submit a quarterly update or make a final declaration. If you've used your free token or you weren't eligible, you'll need to buy one or more.

Support

There's a wealth of information at your fingertips to get you up and running with !Easy MTD. Help, guides, videos and a knowledge base - we've got the lot and an AI helper.

Contact us if you have a question or are still unsure about what to do.