Comply with Making Tax Digital for VAT

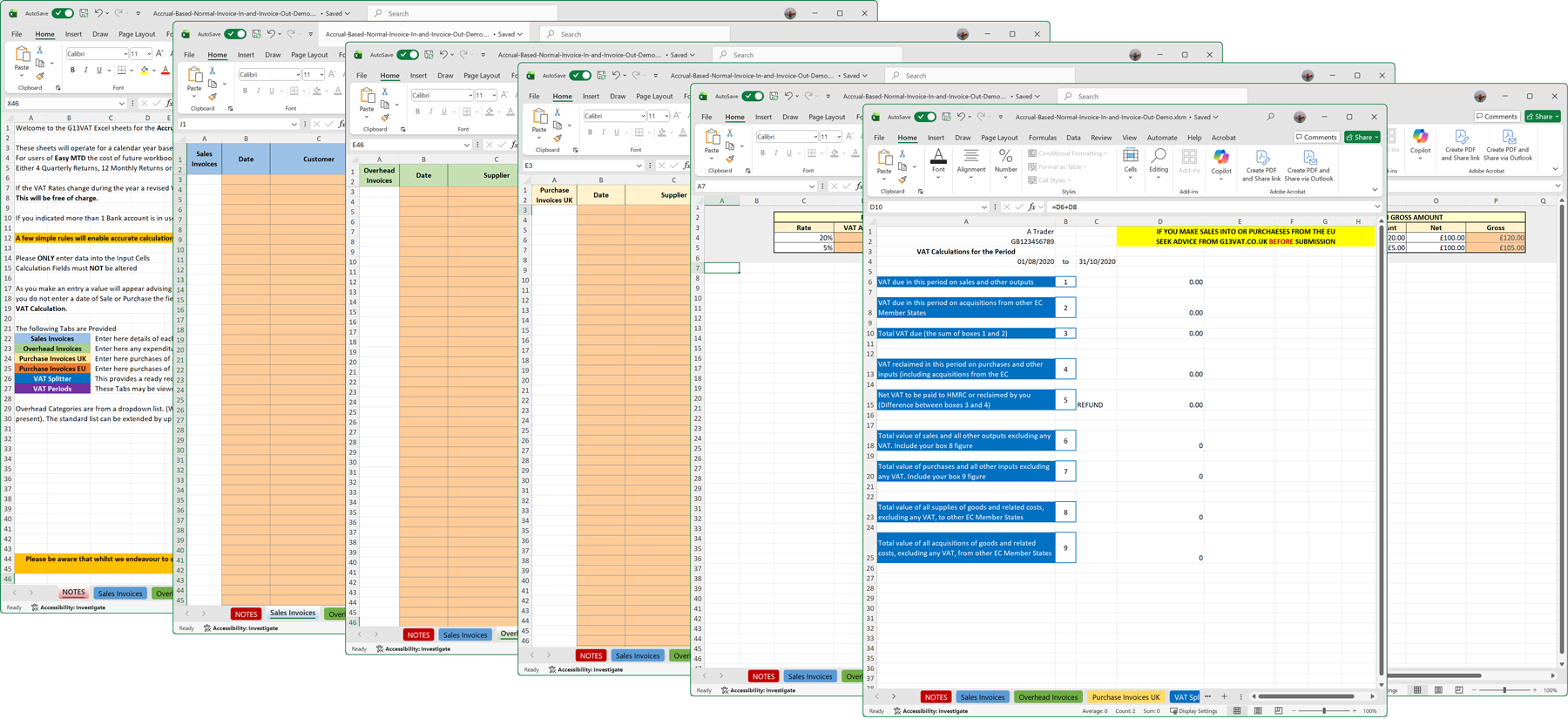

If you need a way to record your business figures so you comply with HMRC's Making Tax Digital for VAT, the following Excel spreadsheet templates are the answer. Each one enables you to input your business figures with ease while automatically calculating the 9 box values of your VAT return. You can then import these values into Easy MTD and submit them digitally to HMRC.

| VAT Scheme | Requirements | Price | |

|---|---|---|---|

| Flat Rate | You do NOT make sales to or purchases from outside the UK | POA | Contact Us |

| Flat Rate | You DO make sales to and/or purchases from outside the UK | POA | Contact Us |

| Accrual Based Retail (7 Schemes) | POA | Contact Us | |

| Accrual Based Normal (Invoice In & Invoice Out) | POA | Contact Us | |

| Accrual Based Margin* | POA | Contact Us | |

| Cash Based Retail (7 Schemes) | POA | Contact Us | |

| Cash Based Normal (Invoice In & Invoice Out) | POA | Contact Us |

All spreadsheets are created and available from leading VAT specialist, Richard Pape, who provides VAT consultancy to businesses and institutions throughout the UK and Europe.

Click here to download Easy MTD so you can start submitting the VAT figures held in your Excel spreadsheet today.

If you already have your own Excel spreadsheet that's fine. Easy MTD is compatible with any Excel spreadsheet as long as it is in the xlsx, xls or xlsm format.