Work your way through the following sections to prepare for submitting a VAT return using Easy MTD.

- Sign up for an account

- Download, install and launch

- Add a business

- Connect to HMRC

- Specify your account

It is assumed your business is VAT registered and your HMRC online services account is ready for Making Tax Digital for VAT.

Sign Up for an Account

You need an Easy MTD account so you can submit VAT returns using Easy MTD.

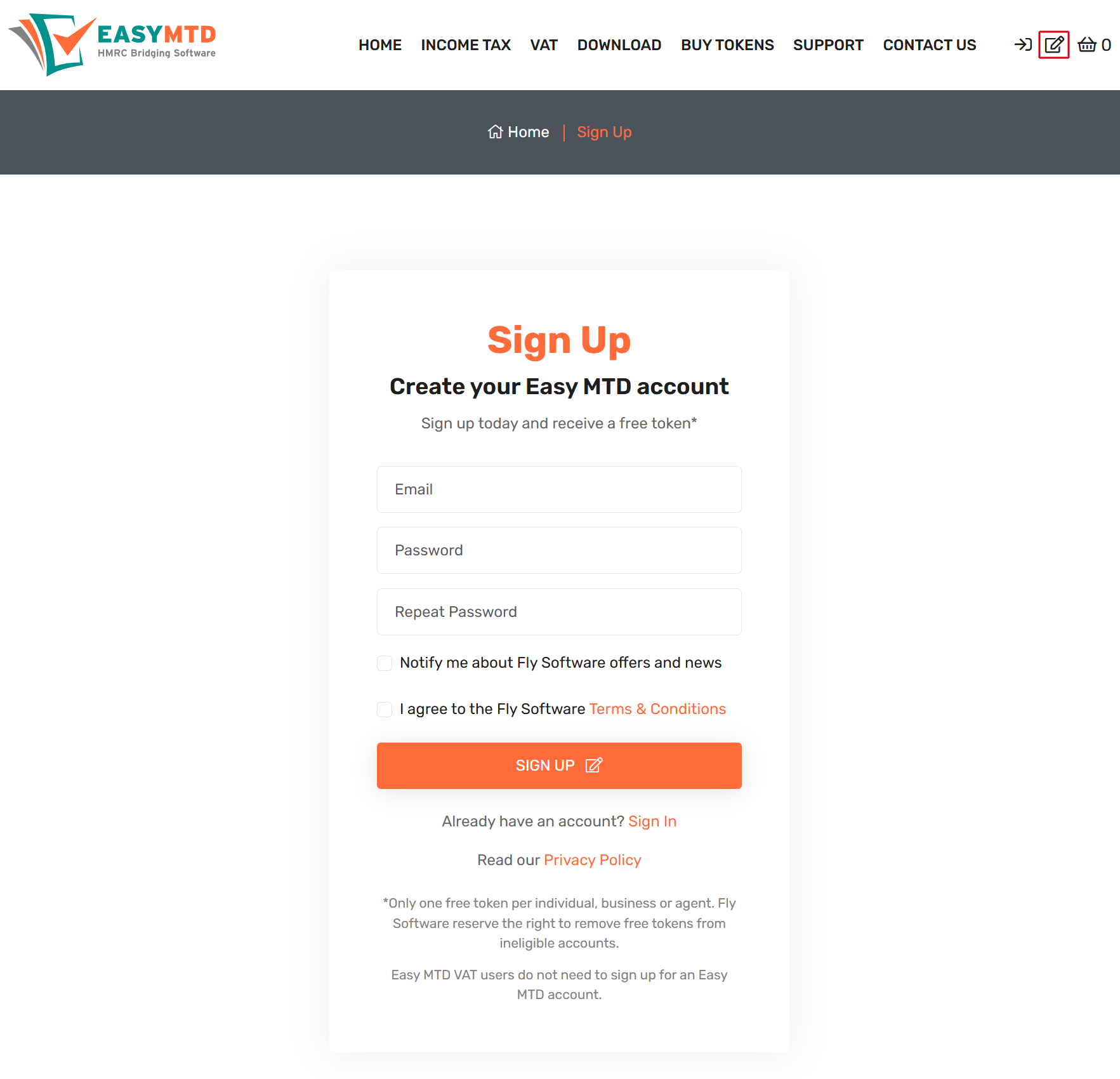

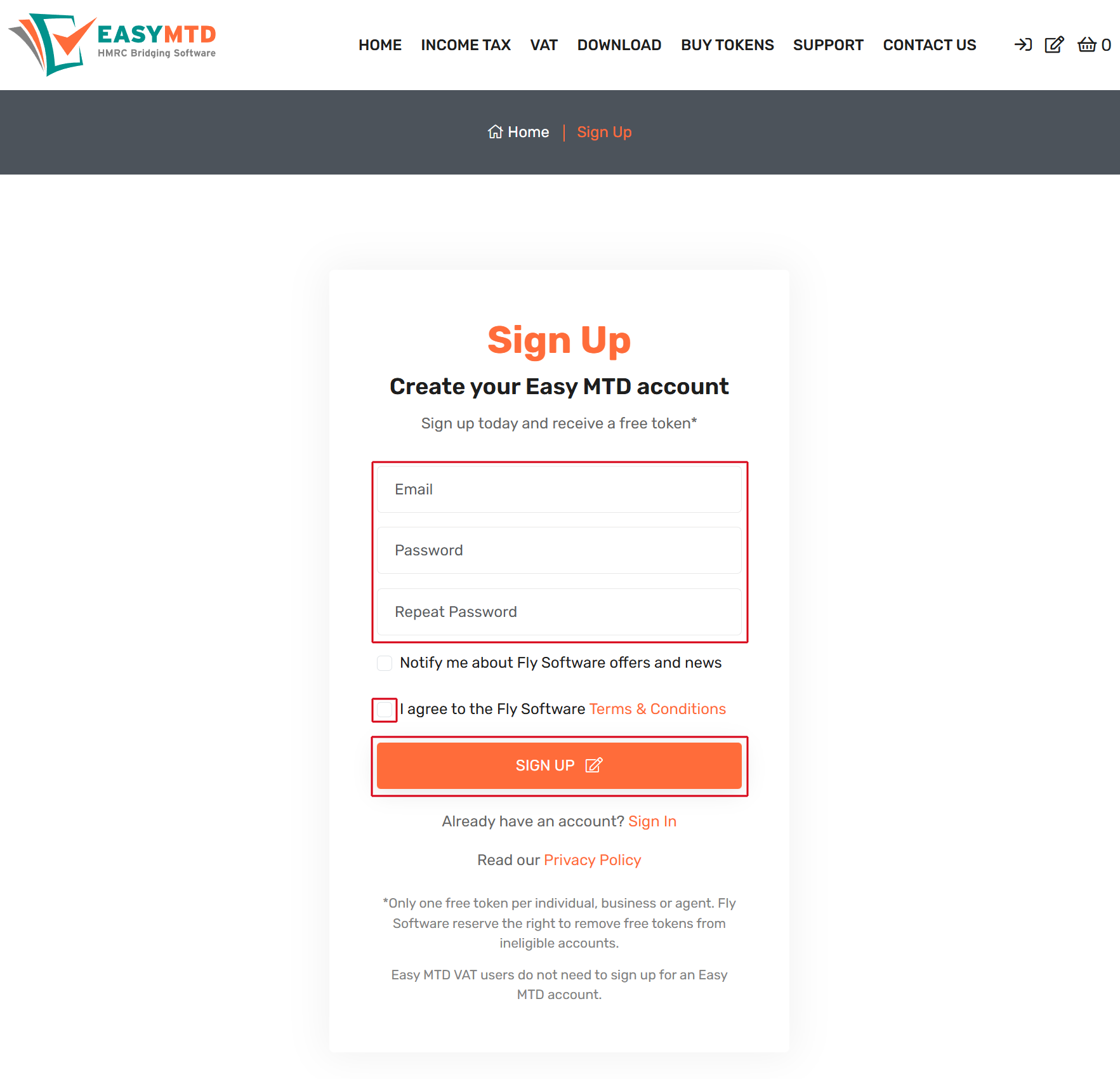

1. Go to the Easy MTD Sign Up page: easymtd.com/account/sign-up

You can also click the Sign Up icon top right of any Easy MTD web page.

2. Specify the requested information then click the SIGN UP button

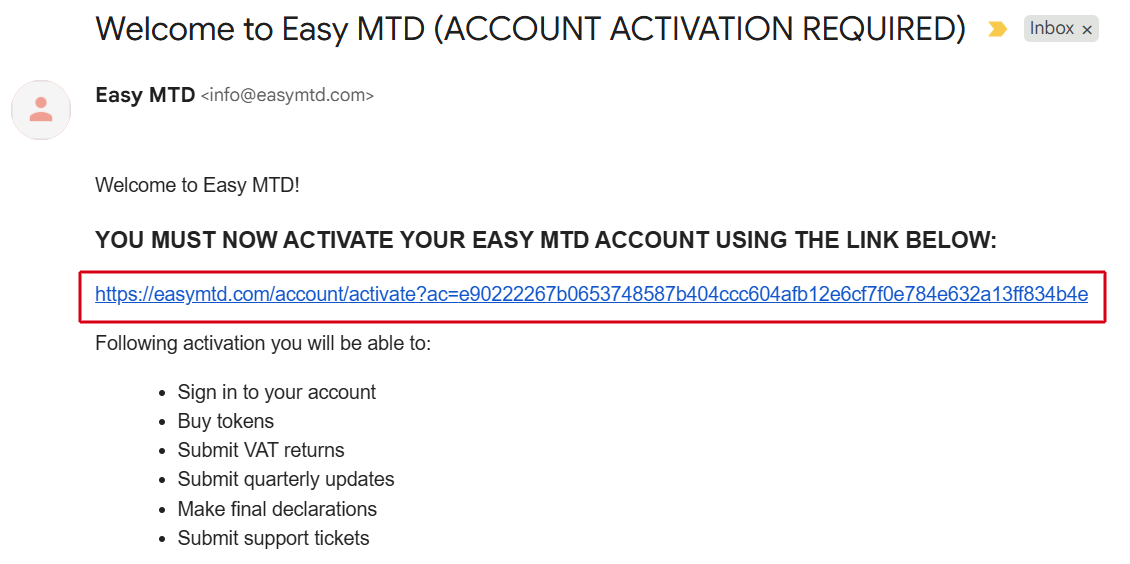

3. Activate your account using the link in the Welcome email sent to you

If you can't find the email check your junk/spam folder or contact us.

Download, Install and Launch

To submit a VAT return, Easy MTD must be downloaded, installed and launched.

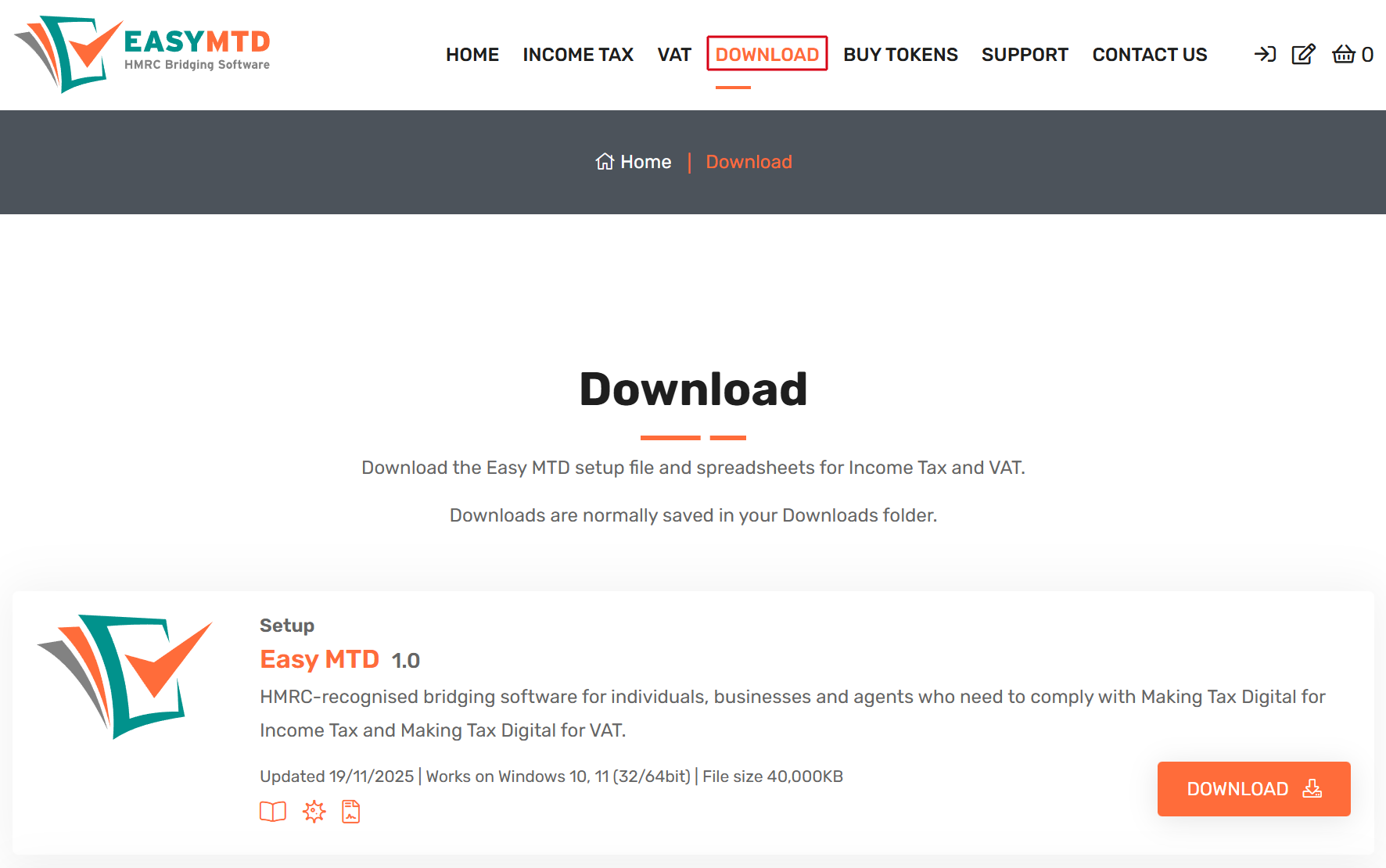

1. Go to the Easy MTD Downloads page: easymtdvat.com/download

You can also click Download menu at the top of any Easy MTD web page.

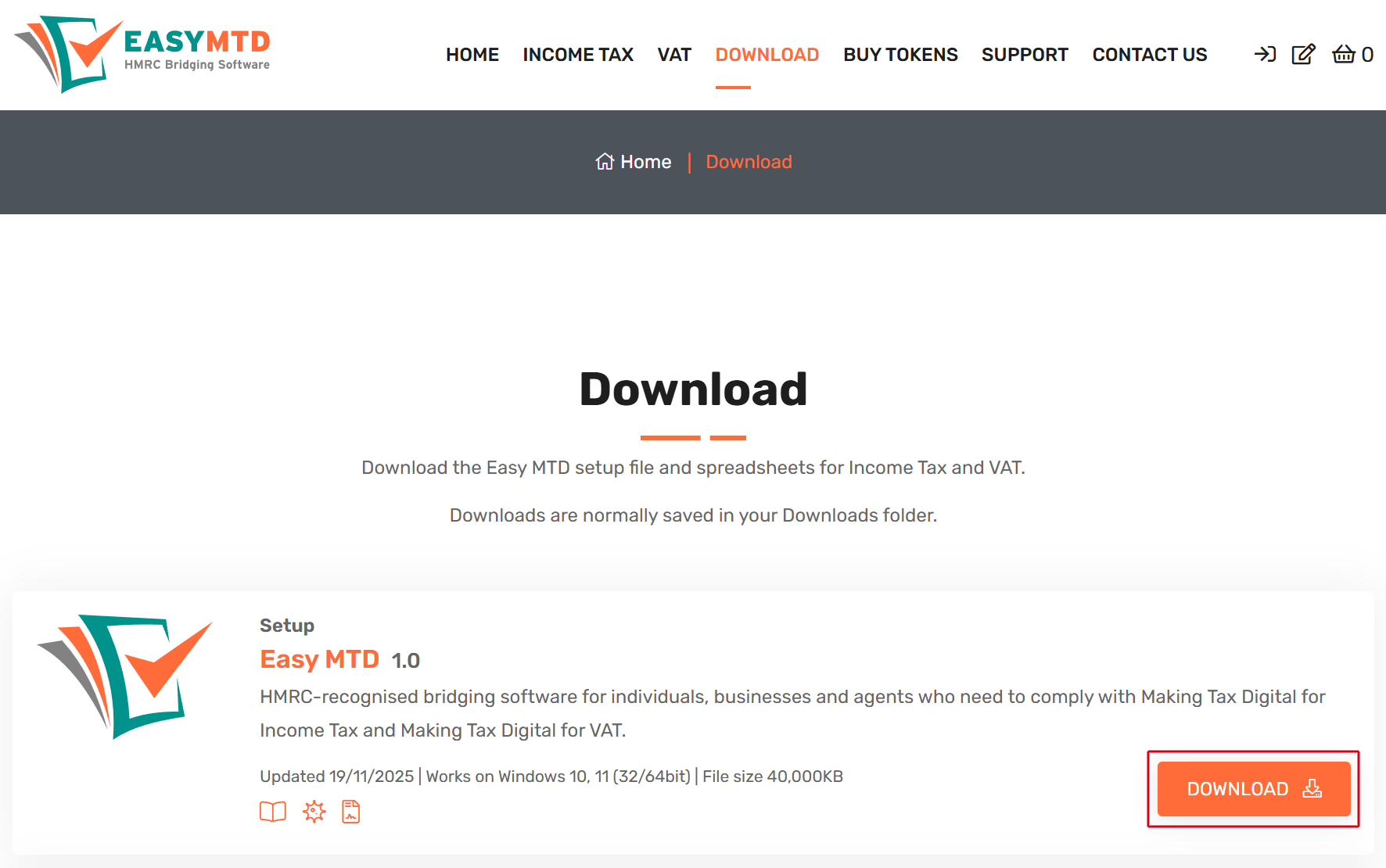

2. Click the Download button

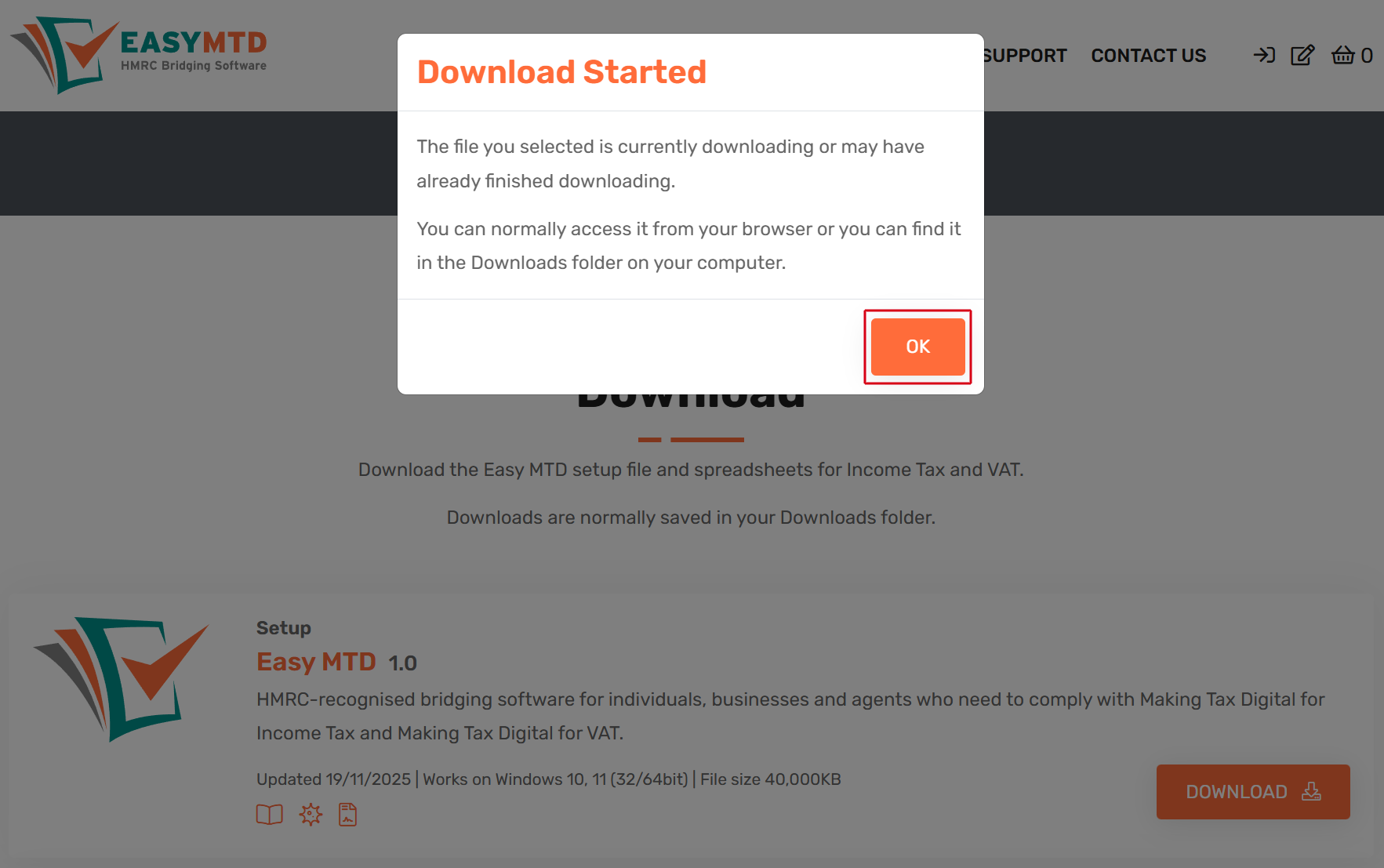

3. Click the OK button

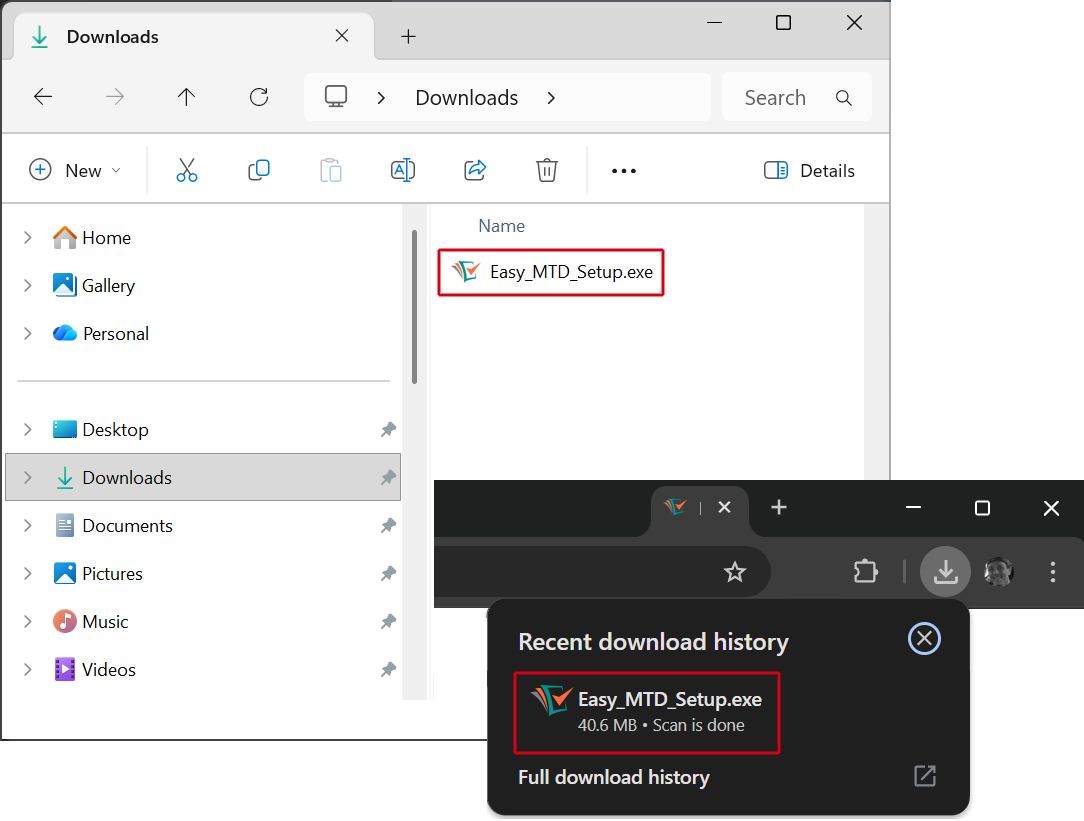

4. When the download is complete, run the Easy_MTD_Setup.exe

The setup file is normally saved in the Downloads folder on your computer and is also accessible in your browser.

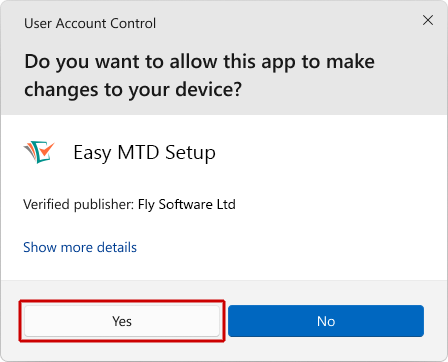

5. Click the Yes button in the User Account Control window

6. Follow the installation steps

6. Double click the Easy MTD shortcut on your Windows Desktop or search for "Easy MTD" in the Windows Taskbar search

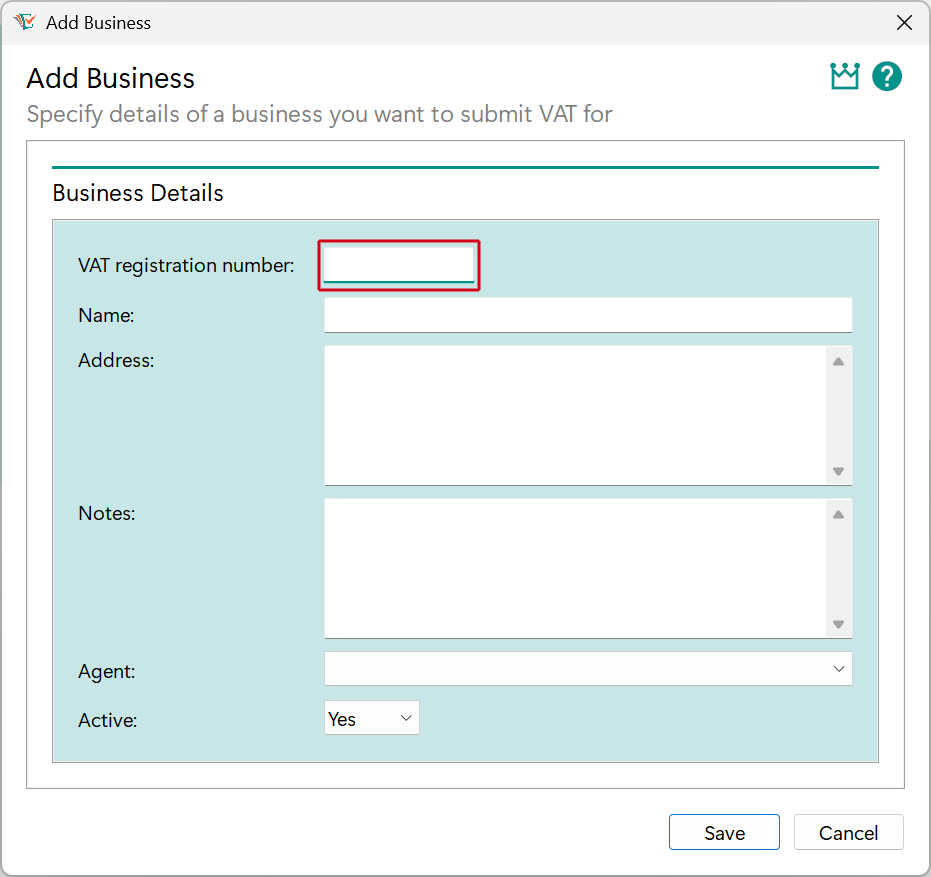

Add a Business

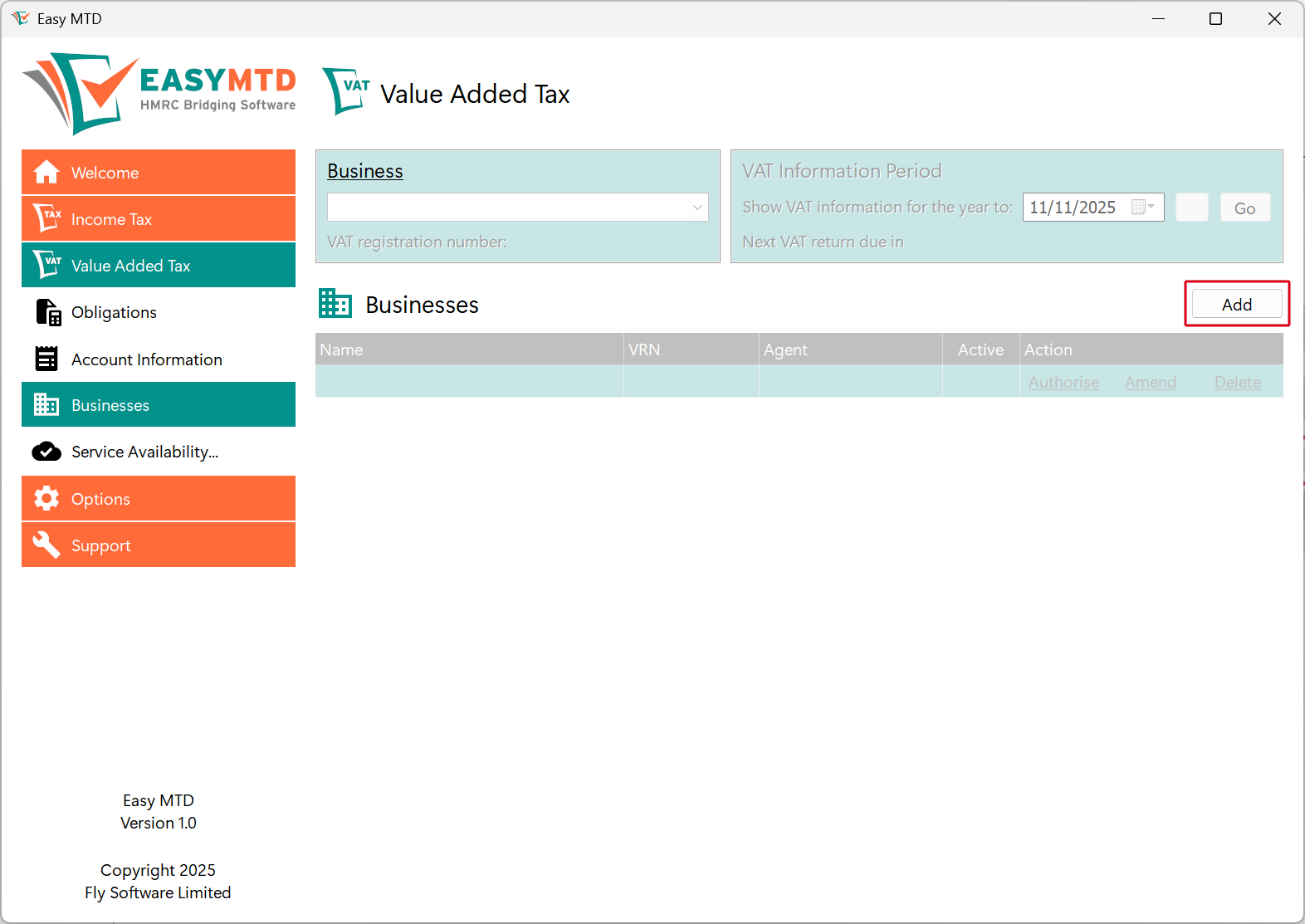

You must add a business to Easy MTD before you can submit a VAT return.

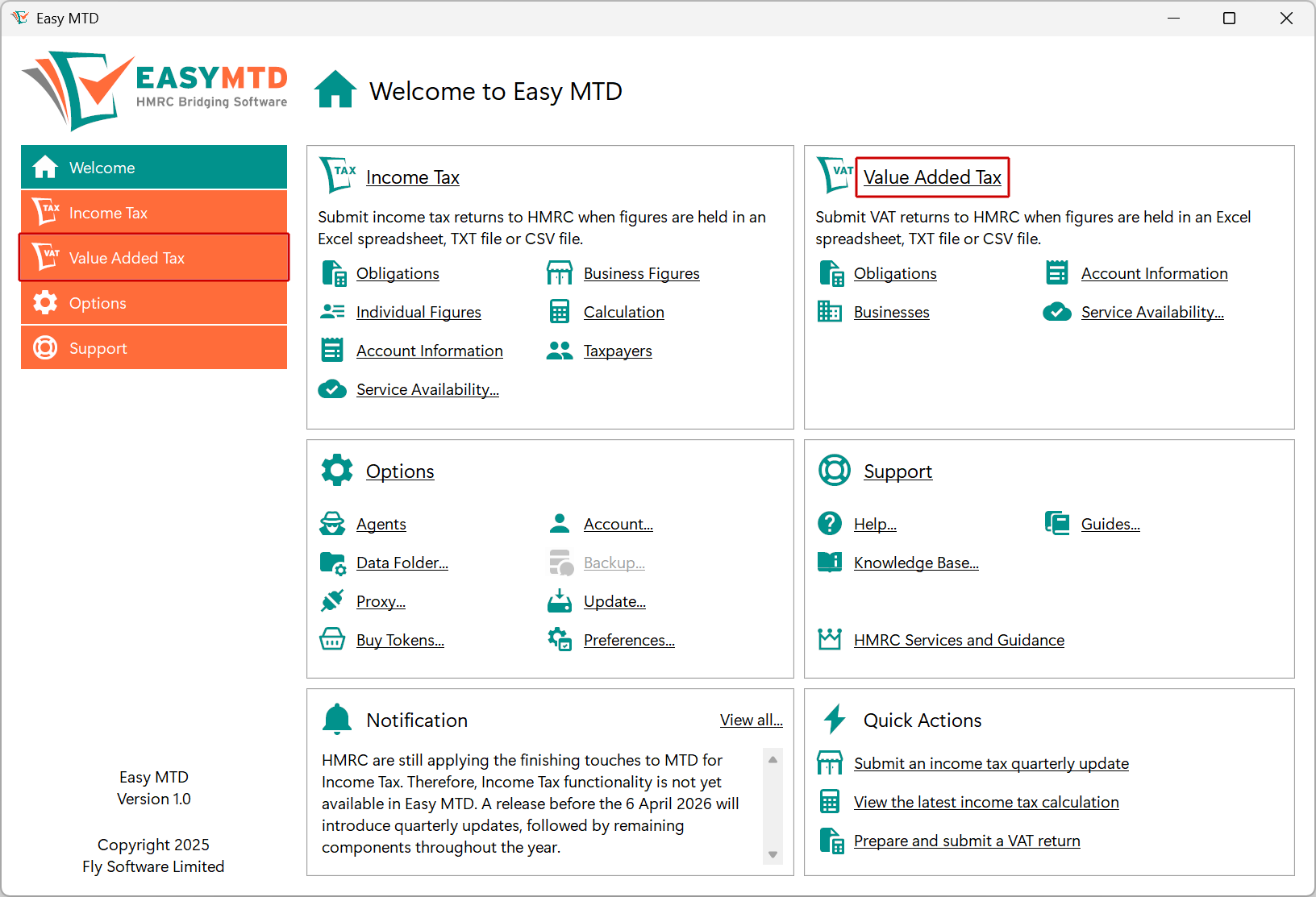

1. Click the Value Added Tax menu or the Value Added Tax link in the Welcome section

If you have not previously added a business you are automatically prompted to add one, or it can be added at any time in the following way:

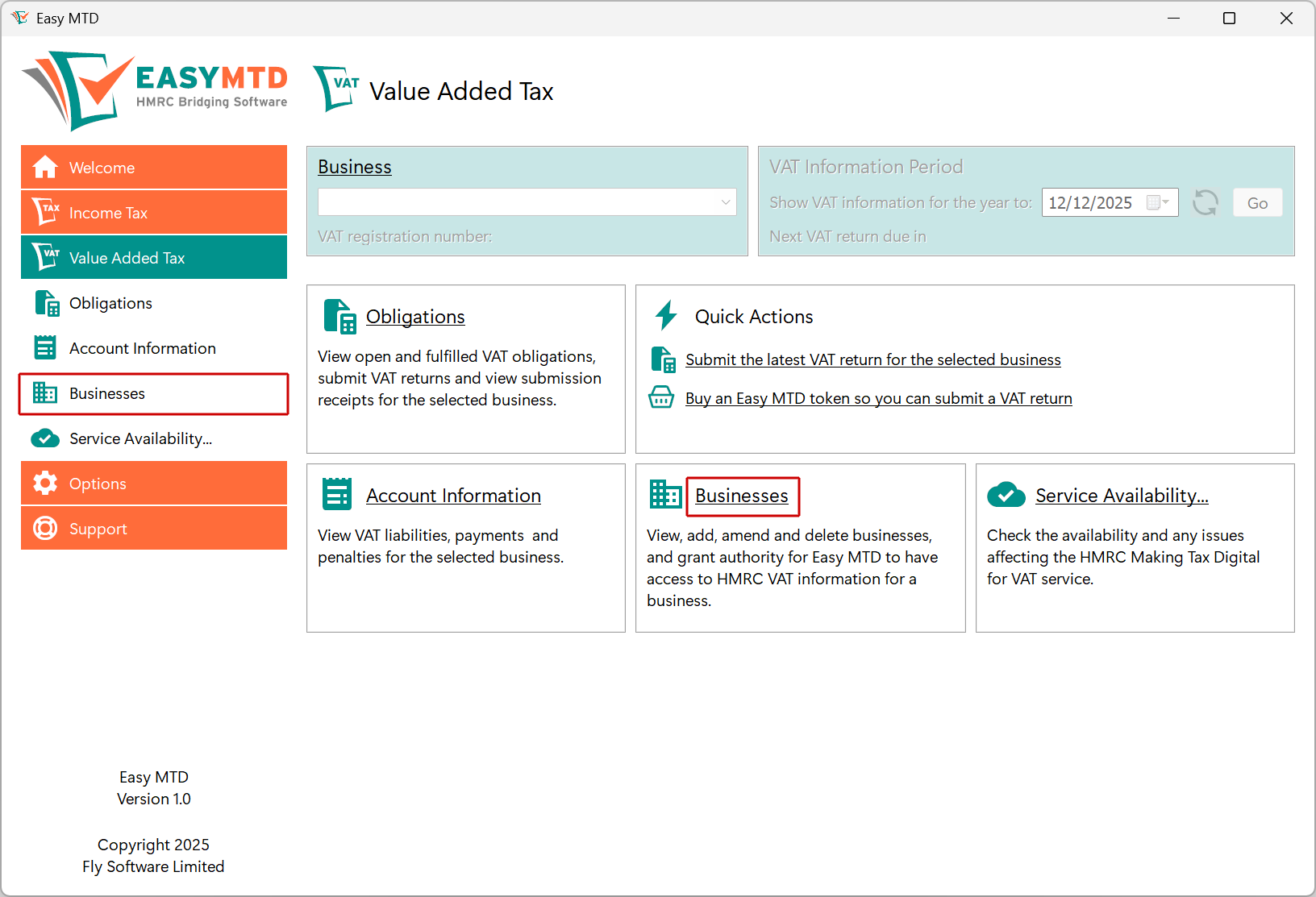

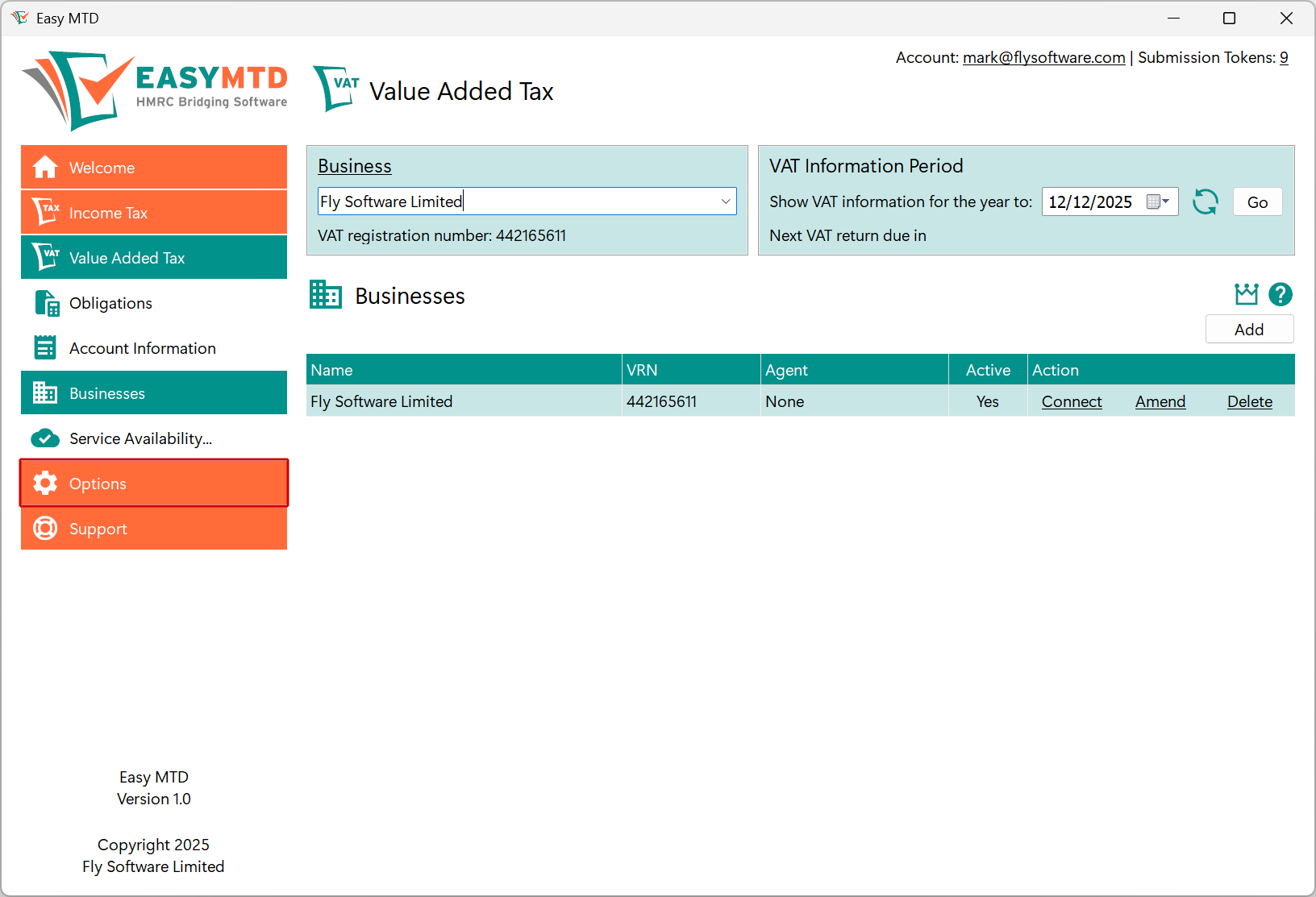

2. Click the Businesses menu option or Businesses link

3. Click the Add button

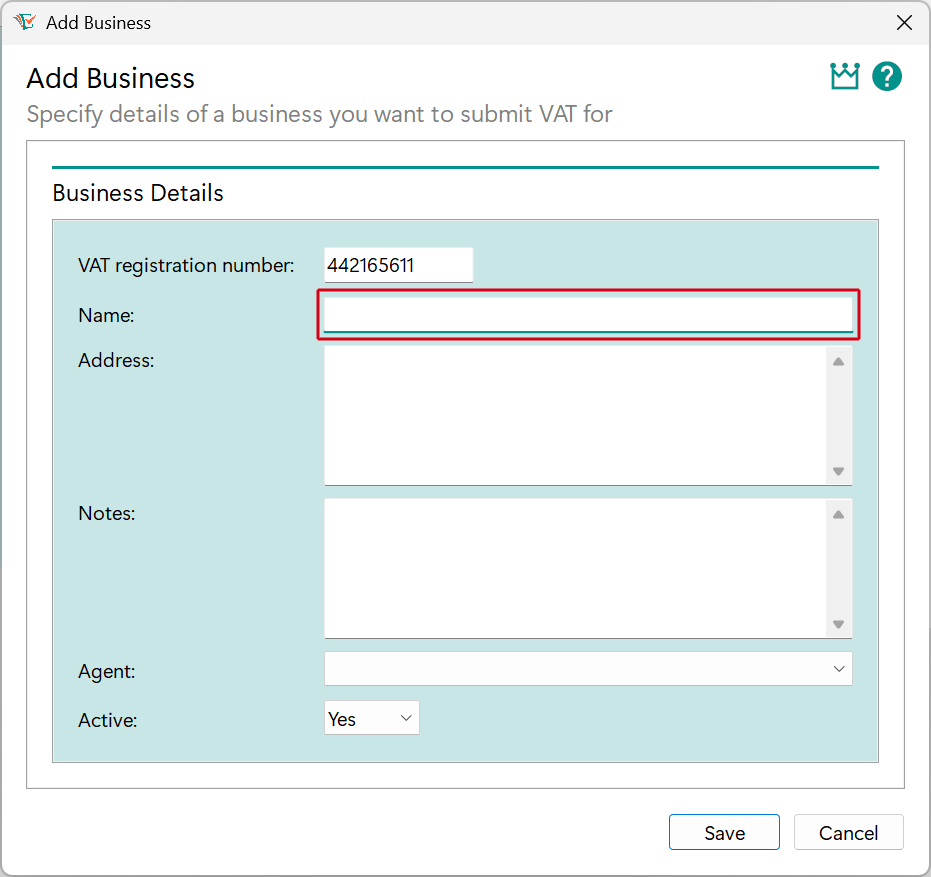

4. Specify the VAT registration number of the business

If you have previously connected Easy MTD with HMRC, a Lookup button will be shown. Click this after specifying the VAT registration number to automatically populate the Name and Address fields.

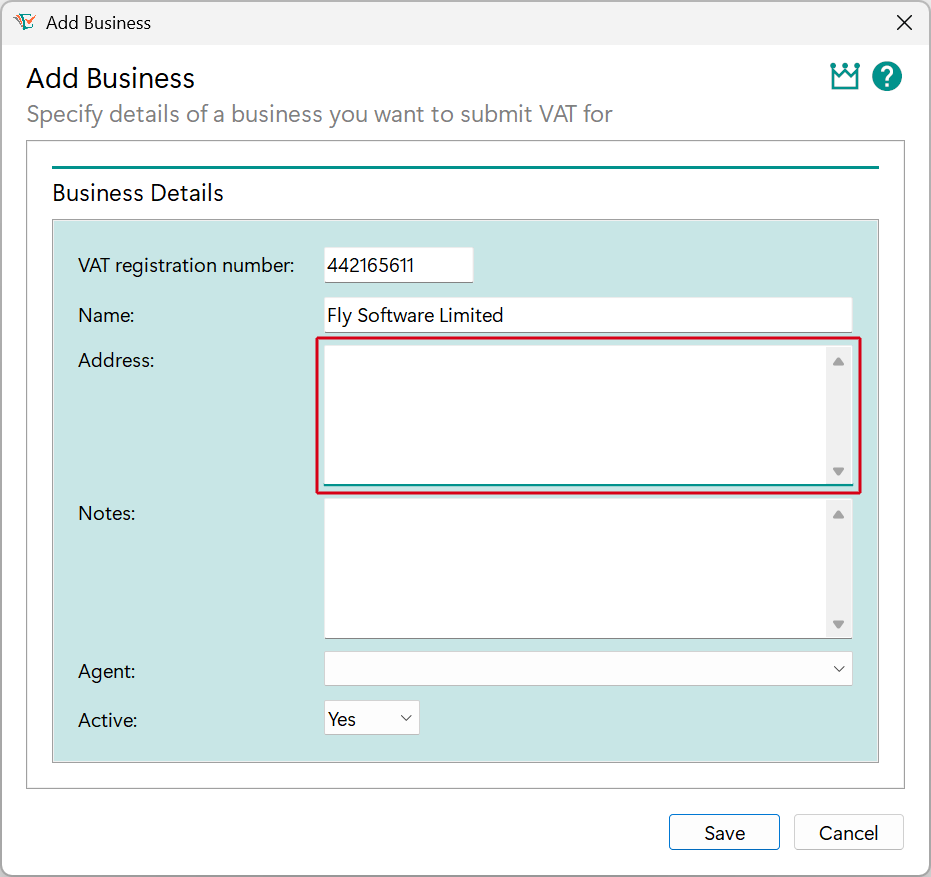

5. Specify the Name of the business

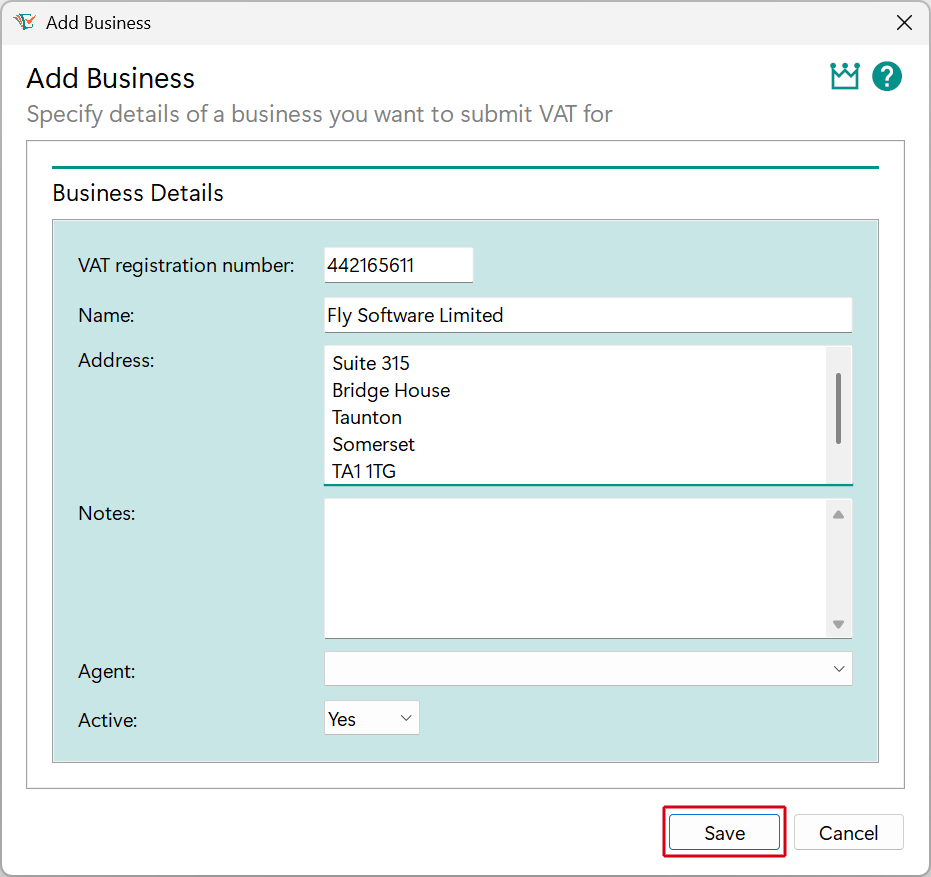

6. Optionally specify the Address of the business

7. Click the Save button

If you are an agent, click here for information about assigning the business to an agent.

Connect with HMRC

Easy MTD needs to be connected with HMRC on behalf of the business.

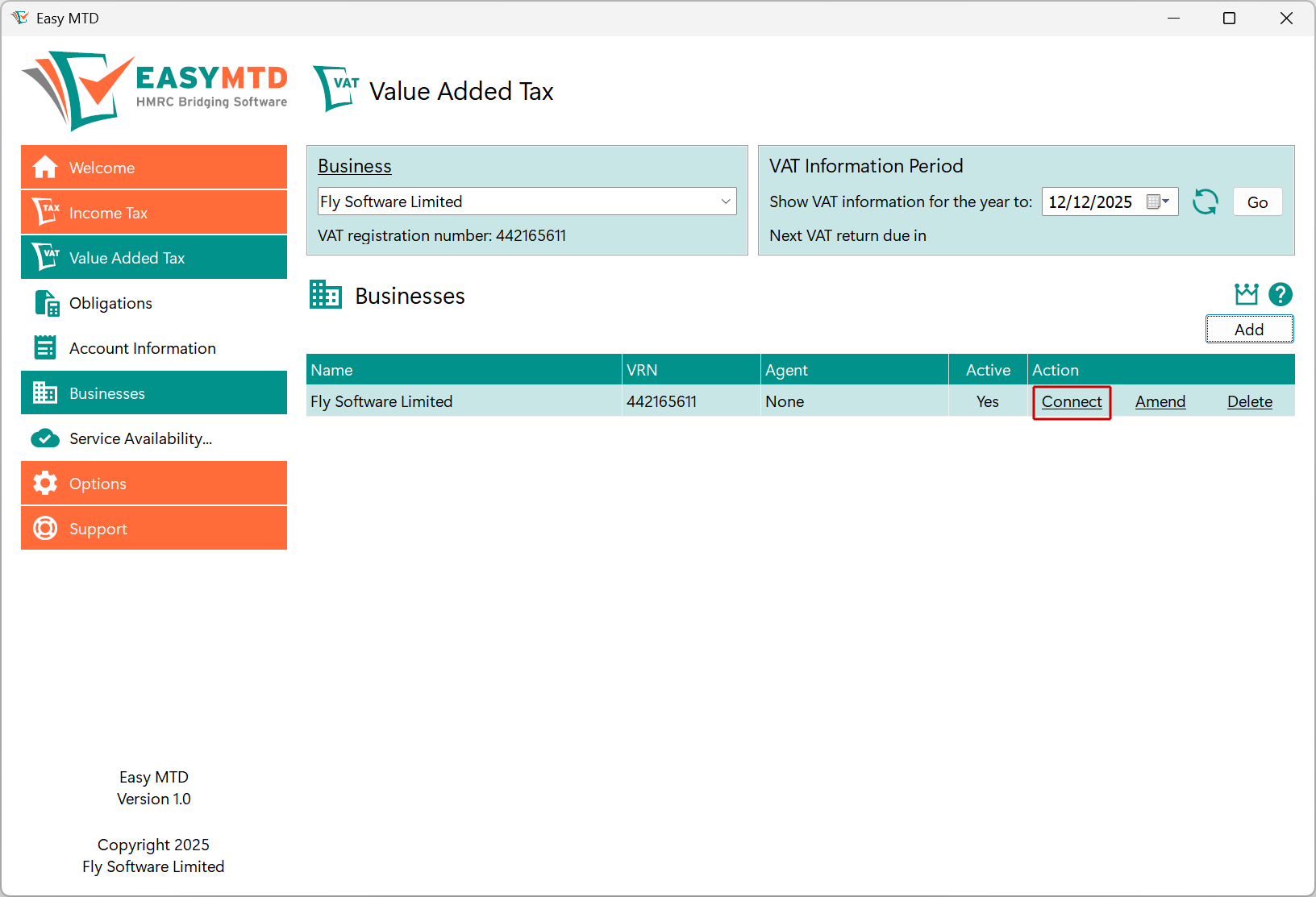

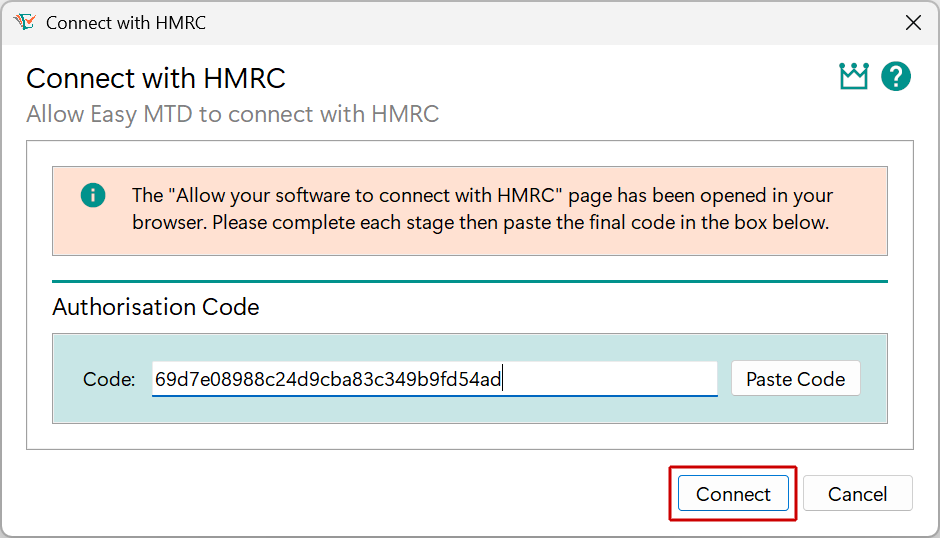

1. Click the Connect link for the business previously added

The Connect with HMRC window is opened and the "Allow your software to connect with HMRC" web page is opened in your default browser.

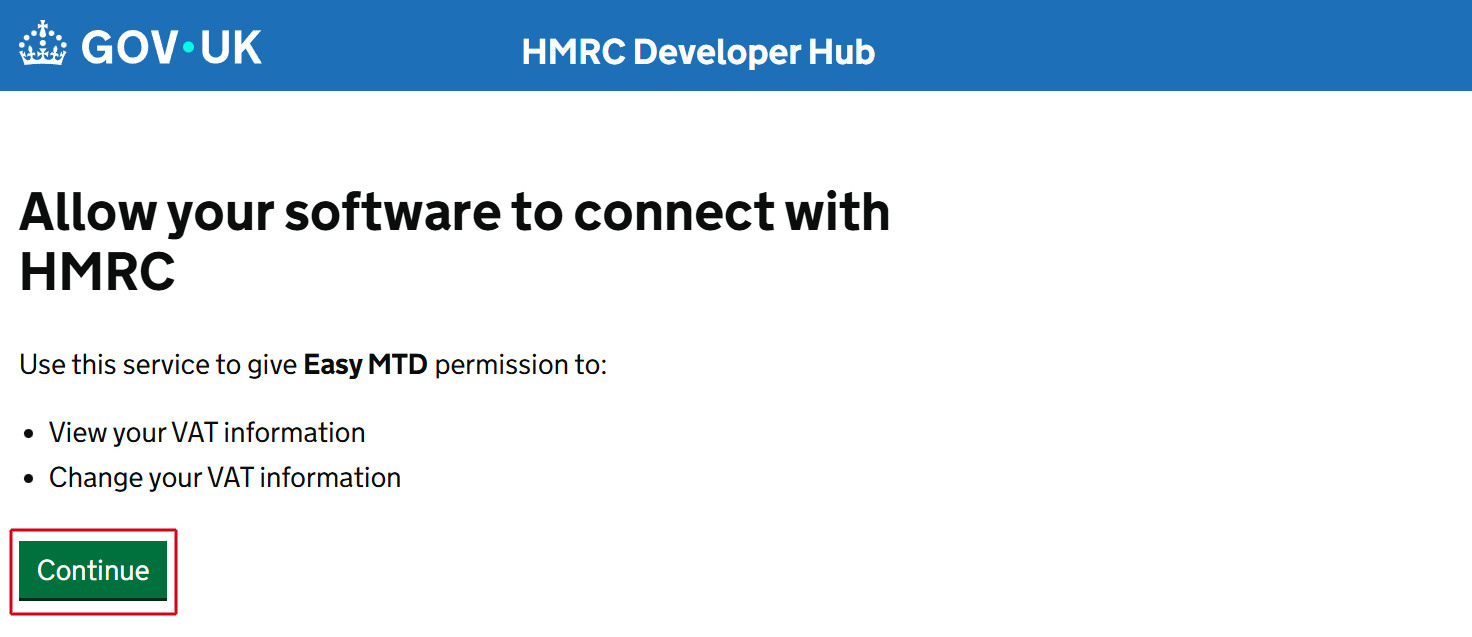

2. In your browser, click the Continue button then follow the connection steps

When signing in to the Government Gateway, remember to use the user ID and password associated with the business you added, or if you are an agent, your agent services account credentials.

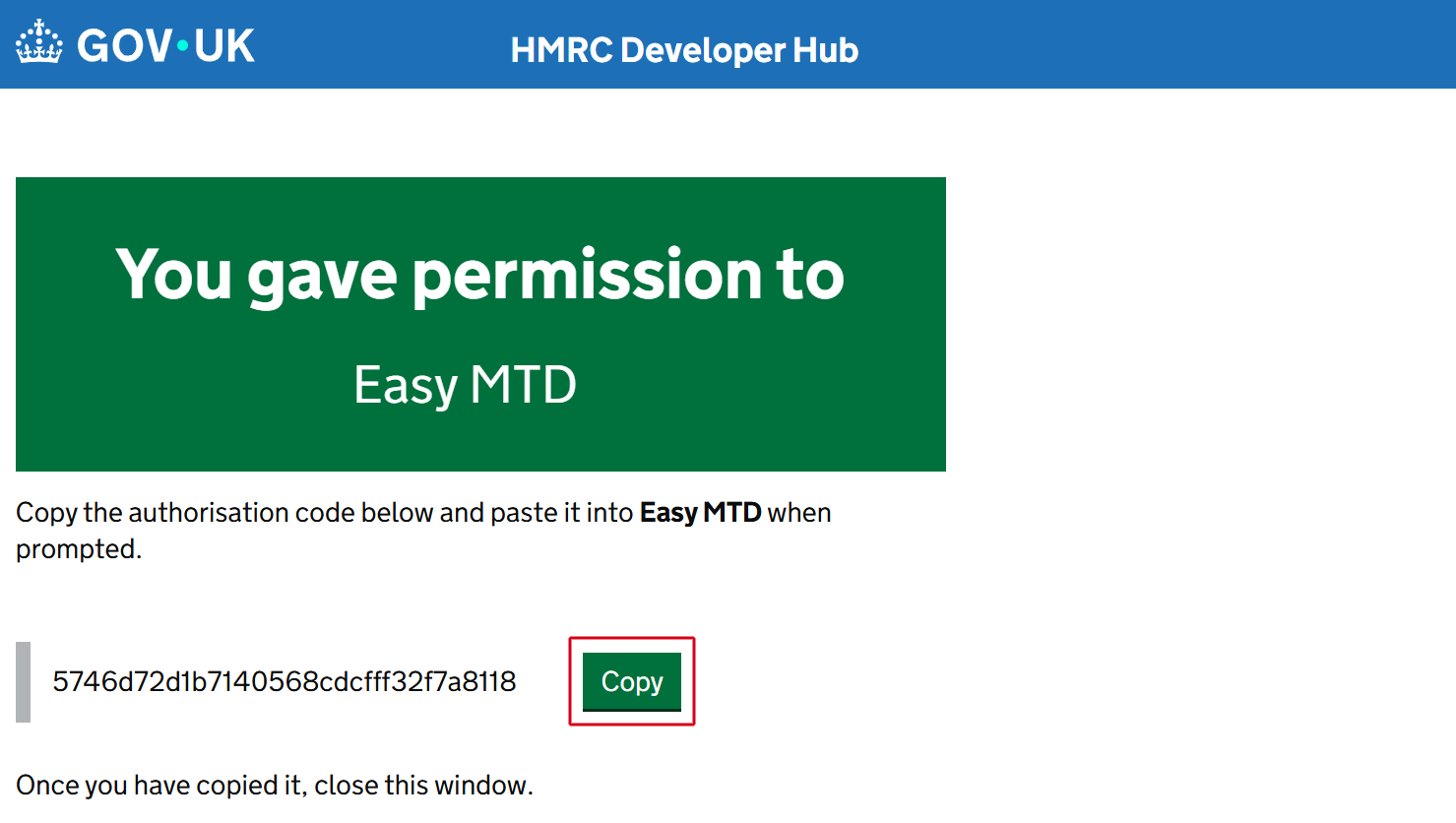

3. Click the Copy button

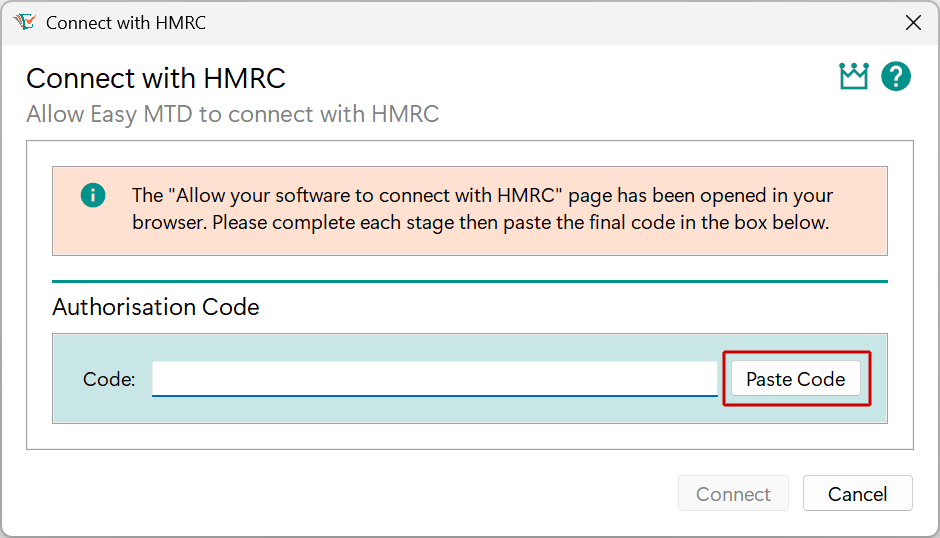

4. In Easy MTD, click the Paste Code button

5. Click the Connect button

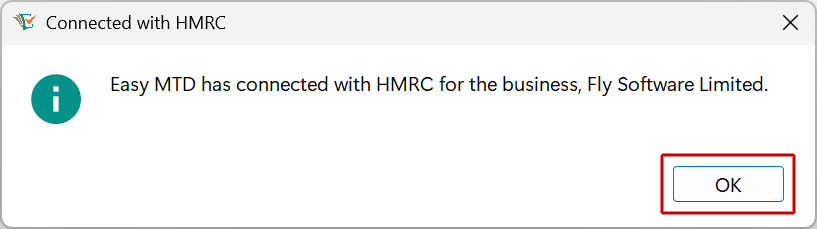

6. Click the OK button

If connecting to HMRC is unsuccessful, click here for information about why this may have occurred and how to resolve it.

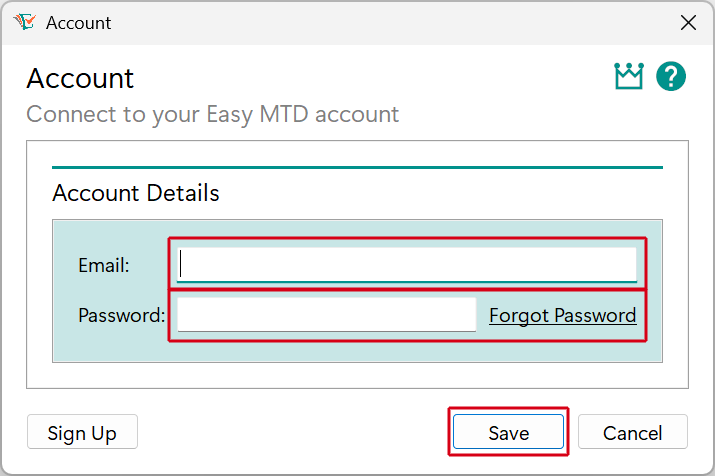

Specify Your Account

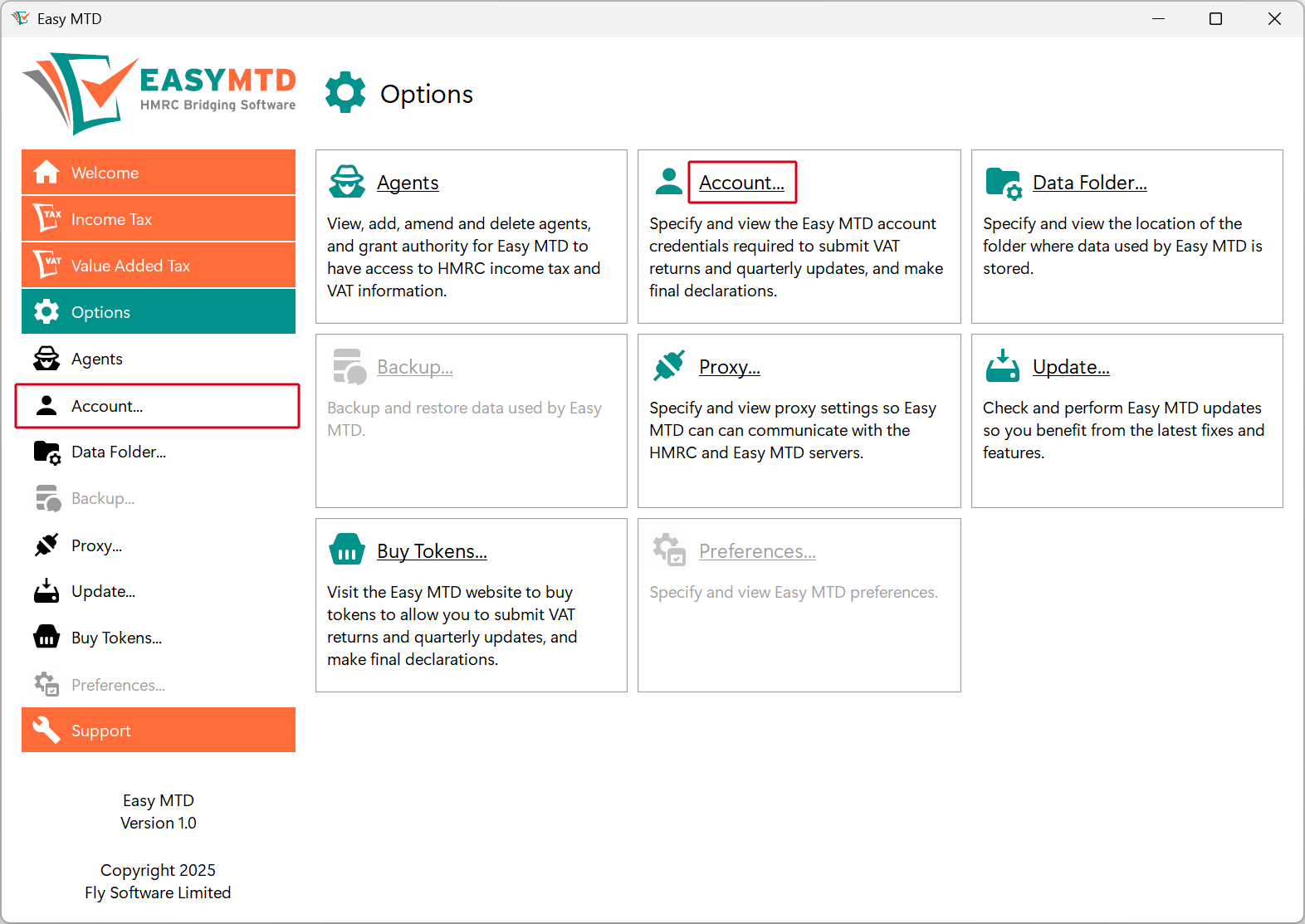

Your Easy MTD account must be specified in Easy MTD before a VAT return can be submitted.

1. Click the Options menu

2. Click the Account option or the Account link

3. Specify your account Email and Password then click the Save button